Oceanía/Australia/Abril 2016/Autor: Adam Creighton / Fuente: theaustralian.com.au

Resumen: La apertura de acceso a los contribuyentes, desde hace tiempo en Australia, de subsidios en un esquema de préstamo de enseñanza superior, a prácticamente cualquier estudiante que es aceptado por cualquier proveedor, de estudiar nada, ha sido un desastre económico.

The Rudd-Gillard government handed out blank cheques from 2009 onwards to universities and unscrupulous vocational education providers, which are still being increasingly and voraciously cashed.

And to the Coalition government’s discredit, they have not been withdrawn.

Thanks to new Parliamentary Budget Office research we now know the fiscal landmines Labor’s “demand-driven’’ education system has planted.

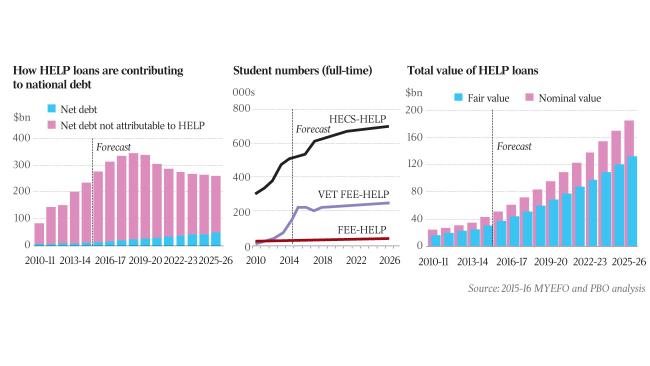

Almost 30 per cent of the outstanding stock of $42 billion in student loans has already been written off. Almost 20 per cent of new loans issued this year for tertiary study are assumed never to be repaid. The annual budget cost of such loans will swell to $11bn a year by 2025.

Opening up access to Australia’s longstanding — and rightly lauded — taxpayer-subsidised higher-education loan scheme to practically any student who is accepted by any provider to study anything has been an economic disaster.

The jobs market has exhibited no marked improvement from the course explosion; indeed, the unemployment rate is higher now. And there has been no noticeable efflorescence of learning and culture otherwise.

The number of university students accessing loans has increased more than 11 per cent a year to 522,000 since 2010. But the real vandalism is in the 147 per cent-a-year annual average increase, to 226,000, in students enrolled at private vocational providers.

Many of these students have been blatantly defrauded.

For instance, one operator picked up $46 million in loans last year to run online courses for 4000 students and produced only five graduates.

This is a system completely out of control. As a stopgap before a more fundamental review, the government should adopt Grattan Institute researcher Andrew Norton’s reform suggestions.

First, the income threshold above which student loans must be repaid should be cut from the current $54,000 to at least $42,000. Almost a third of partnered HELP debtors with incomes below the threshold live in households with disposable annual incomes of more than $100,000.

Second, loans should be reclaimable from deceased estates. Longer-term, the range of courses eligible for government-subsidised loans should be closely scrutinised, with courses deemed to offer little employment benefit excluded.

Nobel Prize-winning economist Michael Spence spoke in 1974 of the “signalling’’ sickness. Students know more about their abilities than potential employers, so use degrees and courses to differentiate themselves from other students. But as more people attend university and complete courses, the brighter students have to accumulate more degrees to distinguish themselves. This results in more people spending more of their lives in educational establishments rather than in jobs, which in many cases do not inherently require much study.

Fuente de la noticia: http://www.theaustralian.com.au/business/opinion/adam-creighton/blank-cheques-mean-books-will-never-balance/news-story/dfe4c3902e84eadceff8bf90de4d6ead

Fuente de la imagen: http://cdn.newsapi.com.au//image/v1/751a09706590f4d1042b1de9a126cb04?width=650

Users Today : 50

Users Today : 50 Total Users : 35403388

Total Users : 35403388 Views Today : 57

Views Today : 57 Total views : 3332683

Total views : 3332683